The Outlook for Aerospace + Defense in a Post-2020 World

As we prepare this year’s State of the Industry, we are feeling a sense of optimism coupled with a strong sense of realism. Both sentiments stretch beyond the world of aerospace and defense. They attach to the overall business market, as well as our personal and professional lives in their entirety. The year 2020 has little need for a summary. Those who read this article understand the dramatic impact it made on all of our lives and many of our businesses. There were some who were fortunate enough to see an increase in business activity, but others for whom the pandemic was catastrophic and everything in between. Regardless of where you ended up on the spectrum from a business sense, there is no one among us who was not affected in some way.

In this article, we analyze the current state of both the commercial and defense sides of the industry, as well as what we can expect in the coming year. We have yet to see what new surprises 2021 will bring, but with vaccines being deployed; companies either adapting, closing, or consolidating; a new administration coming into the executive branch; and the never-halting development of innovative technologies, we know that our world will continue to be marked by change.

Commercial Outlook

Have We Reached the Bottom?

Throughout 2020, the question many kept asking was “Have we bottomed out yet?” Both in the U.S. and internationally, the disappointing progress in controlling COVID-19 contributed to the most negative hit to commercial air travel since World War II. After a sledgehammer spring, the industry started to show signs of life as the virus curve flattened, and TSA throughput numbers began a modest climb. However, those numbers plateaued this fall as the second wave came and many governments and global businesses extended their no-travel policies. With airlines such as American and Delta burning upwards of $45-$50 million per day, the ripple effect through the supply chain has continued to be severe. This coupled with many of the suppliers’ already terrible woes from the 737 MAX grounding created an unwinnable situation last year.

We believe the bottom is likely to be here in Q1 of 2021, possibly extending through Q2. With the vaccine now being deployed and the 737 MAX recertified, many now see the light at the end of the tunnel. However, even though Airbus and Boeing are now forecasting deliveries in 2021 to resemble 2019, Boeing is dealing with a large fleet of MAXs on their hands ready to go. So, it is expected that build rate recovery will be modest.

Currently, both suppliers and OEMs have a massive amount of inventory sitting in their systems. The OEMs have been very effective in pushing working capital requirements back into the supply chain. Many suppliers are facing the impact of volume dropping, putting pressure on their balance sheets due to inventory staying put. Pre-COVID, you would see OEMs and Tier 1s leveraging many different suppliers, moving things around to get the best price. As the reality sets in that many suppliers will be going out of business if their prices are pounded any further, this strategy will likely not work as well. Those who previously overinvested in CapEx and inventory will struggle to survive, and we predict that we will see an uptick in bankruptcies and consolidations this year.

Airline Transformation

We are currently seeing a significant transformation in airline fleets. In 2020, we saw airlines officially say goodbye to many platforms — from the wide body 747s and A380s, to the narrow A330-300s and CRJ200s, among others. As many of these aircraft get dismantled, we will see an effect in the aftermarket, as there will be a suppression of demand for certain engines and other parts. In 2021, we will see a large volume of 737 MAXs, which have been sitting idle, finally come into service. As discussed above, this will continue to affect companies whose performance is tied to OEM build rates.

There is a lot of talk these days about the prospect of long-range single aisle aircraft becoming more prominent. While there will still be a demand for double-aisle aircraft on longer transoceanic routes, we should eventually see an increase in single-aisle aircraft taking the place of some routes previously flown by the likes of 787s or 767s. However, this will likely take several years to manifest and will not be viewed as a short-term effect.

We also cannot forget the increasing amount of digital transformation taking place across the industry. Despite the extreme slowdown in air transport in 2020, it was still a year of accelerated technology adoption in areas such as touchless technology and biometrics. Automation and biometrics will become more and more prevalent at airports across the globe. We can expect to see innovations from cutting technologies — like IoT, AI, and machine learning —seep into our travel experiences more each year.

Investors

Figures released by PwC showed a record number of private equity deals in 2020, and the outlook for 2021 is very strong. When it comes to commercial aviation, there is a lot of interest from both sponsors and strategic buyers coming into this year. While the next two years look quite grim for the industry, the majority of executives and investors we speak with believe the long-term outlook remains strong. We expect to see a significant amount of deal flow this year.

However, the reality is that for private equity investors, the ability to gauge appropriate valuations for companies in the commercial supply chain is difficult at the moment. There are still many unknown factors with how the COVID-19 vaccine distribution and adoption will play out as well as the potential long-term changes in business travel habits. Trying to select the winners and losers with looming consolidations and bankruptcies will still be challenging for at least the first half of this year.

Defense Outlook

Continued Stability

2020 was a strong year for the defense industry, and this is expected to continue through 2021. Some of those outside the industry are questioning whether or not a Biden administration will affect defense spending this year. While that could be a possibility in the future, 2021 should not see any sort of slow down with programs that are already in full swing. As we recapitalize programs such as the F-35 — the replacement of the Minuteman missile — and introduce the Columbia-class nuclear submarine, companies with a stake in their supply chains should continue to see rising demand throughout this decade.

While these new platforms are very well funded, another trend we are seeing is the updating of legacy programs. The United States has a massive arsenal of weapons that need to be transitioned into “smart weapons” in order to integrate with new platforms such as the F35. This will continue to drive growth, particularly within the electronics supply chain.

New Records in FMS

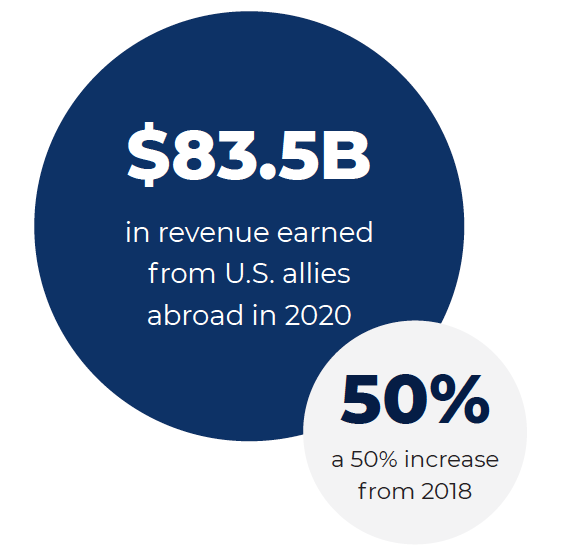

Another strong trend is the significant increase in Foreign Military Sales. In 2020, the U.S. State Department recorded a record-breaking $83.5 billion in revenue earned from our allies abroad. This was up roughly 50% from the previous record of $55.7 billion in 2018. The largest regional customer was Asia, with $44.1 billion coming from allies in the Pacific, followed by Europe ($21.1B), the Middle East ($11.5B), Africa ($5.1B), then Central and South America (less than $1B), and Canada (less than $1B).

Looking at our current world state with players such as China, Russia, and Iran, there is reason to believe that demand from our allies will remain strong in these regions. Factors that also affect FMS include energy prices and congressional oversight. Although, with our current deficit, we do not believe Congress will pass up the opportunity to rake in billions in revenue from this market in the coming year.

Investors

Given the harsh realities of COVID-19 on the commercial side of the industry, there are many now looking for resiliency in aerospace investments. Defense seems to be the place to look at as far as performance this past year. As discussed above, we are likely to see continued growth for all those in the supply chain of major programs such as the F-35 or Minuteman missile replacement. Other areas that will command a large portion of the R+D defense budget include unmanned and autonomous systems, hypersonic weapons, and space-related technologies, such as launch vehicles and Exoatmospheric Kill Vehicles. All of these areas should be considered good for investment.

There is always the possibility, however, of sharper cuts to the defense budget than anticipated. Due to ever-increasing deficit, worsened by recent COVID-19 bailout programs, it is always possible that the new administration will look to cut spending across the board sooner than later. Some of the more expensive programs mentioned above could be on the chopping block. However, we do not believe this to be likely.

We have also heard words of caution from investors relating to the overvaluation of companies in the defense supply chain. As the stability of this sector has made it very attractive through the pandemic, it has driven valuations very high, and it is possible the market could overcompensate. Wise players in the A+D industry will likely still place a high value on staying diversified.

Need for Strong Leadership

A post-COVID world suggests that we could see significant change when it comes to executive leadership. In the corporate world, it is expected that many executives will continue to rethink their lifestyles when it comes to things like location and travel. As private equity activity increases, we can expect a strong need for talent at the portfolio company level. Throughout all companies, we can also be sure of seeing increased calls for more diversity in the executive ranks. If 2020 has taught us anything, it is to be ready for the unexpected. There will no doubt be surprises along the way which will continue to test our determination and ability to adapt through unchartered waters. While we cannot anticipate all that 2021 will bring, we do know that there will be a demand for strong leadership on both sides of the industry unlike any we have ever seen.

This of course is good for our business, as the war for talent should be quite fierce this year, but it is also a great sign for many of our clients. Periods of change often represent great opportunities for innovation, and many companies who have been battle-tested this past year will move into a good position to sow the seeds of long-term success.

Jared Moriarty

Managing Director

moriarty@mbexec.com

Jared is a Managing Director at McDermott + Bull, based in the firm’s Southern California headquarters. He co-chairs the firm’s Aerospace + Defense practice, leading search engagements for clients across the nation. He is a licensed private pilot, based out of John Wayne Airport in Orange County, and his aviation experience has proven invaluable with many of the firm’s clients. Jared received a Bachelor of Science in Finance from the University of Connecticut and his MBA from Chapman University.