2021 Outlook

As we bid farewell to a year like no other and embark on a new chapter in 2021, we consider what’s ahead. The events that unfolded on January 6 at the U.S. Capitol caused widespread revulsion, and 2021’s sad start can only hopefully get better. To say the appearance of last year’s novel coronavirus turned the world on its head is an understatement. It caused worldwide disruption, job loss, illness, death, and economic collapse. Since the coronavirus outbreak hit, a study by the Pew Research Center shows one in four people in the U.S. have struggled to pay monthly bills; one in three have dipped into savings or retirement accounts; and one in six have borrowed from family or friends to cover bills or get food from a food bank. These types of experiences continue to be more common among adults with lower incomes, those without college degrees, and Black and Hispanic Americans.

Following a steep decline in early 2020, the world economy rode a rebound that began in May and remains on track for strong post-recovery growth in 2021. Consumer income fell in November, layoffs continue — particularly in hard-hit industries like restaurants and bars — and the unemployment rate remains high. However, recent economic data is encouraging and suggests that our national economy will recover. While rising COVID-19 cases in the U.S. and Europe make it difficult to envision a return to normalcy, the global economy has proven remarkably resilient. As markets emerge from their winter lockdowns, they will likely drive global GDP growth, followed by reopening economies in the U.S. and Europe as the vaccine rollout gathers steam.

SINCE THE CORONAVIRUS OUTBREAK

IN THE U.S.

1 in 4

people have struggled to pay monthly bills

1 in 3

have dipped into savings or retirement accounts

1 in 6

have borrowed money from family or friends to cover bills or get food from a food bank

The Year of Community Financial Institutions

1/3

of small businesses turned to small banks for their lending needs

Although America had never experienced a health and economic crisis like this before, 2020 was the year of the Community Financial Institution. Measures taken to contain the virus and manage the sudden stop to the economy in March were unprecedented. Small businesses, which tend to be service-oriented and clustered in retail and food services, were adversely affected. Unlike larger companies, many cannot maintain operations via remote work. Since community banks and credit unions are a major source of credit and financial services to small businesses, this crisis had a major impact on their local communities. It was no surprise then that community financial institutions stood shoulder to shoulder with their customers. The Federal Reserve’s Small Business Credit Survey shows that over one-third of small businesses turned to small banks for their lending needs. In one survey of more than 1,000 financial institutions, over half of U.S. banks and credit unions expected an “extreme” or “severe” impact to their communities.

One of the government’s first responses to the pandemic was to introduce the Paycheck Protection Program (PPP), which was geared toward small businesses and dependent on community banks and credit unions. PPP was timely and effective in helping millions of businesses weather the lockdown period, and its design made community financial institutions integral to its success. The first funds reached businesses roughly three weeks after the need for relief was recognized. To put this in perspective, $525 billion, or roughly 19 times the value of all Small Business Administration lending in fiscal year 2019, was distributed in four months from April through August 8, 2020. In addition, many community financial institutions reduced or eliminated penalties or fees on credit cards, loans, or deposits for their customers.

Community Bank Initiatives

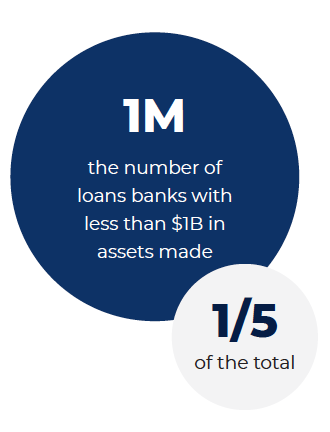

Community banks with $10 billion or less in assets made about 40% of the overall number and value of PPP loans. “Community banks were absolutely essential to the success of the program,” said Michelle Bowman, Governor on the Federal Reserve Board. She stated that banks with less than $1 billion in assets made one million loans under the PPP, about one-fifth of the total, delivering $85 billion in relief to their customers. The smallest banks made the smallest PPP loans on average, illustrating that these banks play a key role in serving businesses that may be outside the focus of larger banks. The average PPP loan size at banks with total assets under $500 million was just $72,000, about half the size of the average loan at banks with total assets between $10 billion and $100 billion.

%

of all PPP loans made to small businesses owned by non-whites were by community banks

Preliminary data from an Independent Community Bankers of America report indicates that community banks were the main source of lending for minority-owned small businesses during the pandemic, accounting for 73% of all PPP loans made to small businesses owned by non-whites. Early estimates also suggest that community banks provided 64% of PPP loans to majority veteran-owned businesses.

Credit Union Response

Credit unions provided substantial assistance to their members in 2020, particularly in the wake of the COVID-19 crisis. They initially focused on emergency relief and crisis management to help rural communities, small businesses, and underserved communities. According to data from the SBA, as of June 30, 2020, credit unions made more than 196,000 loans, averaging $49,487 per loan, indicating credit unions continued to focus on Main Street businesses to keep local communities strong across the country. Those loans supported 1.18 million jobs. According to the Credit Union National Association, while credit unions helped both consumer and commercial members, their primary portfolio of business typically focuses on consumer lending.

Now, credit unions are emphasizing employee safety and security, maintaining services, and providing support to members — especially those facing financial stress. Many are also finding ways to support and rebuild their communities, such as through matching employees’ donations to relief programs. They are refocusing on their people — employees and members — and investing in business continuity and business resiliency to support the community. Credit union loan growth is expected to reach 6% in 2021 and credit union deposit growth is expected to reach 8% in 2021.

1.18M

the amount of jobs supported by credit union loans

Trends in Executive Hiring

In our industry, the pandemic shone the brightest light on two functional verticals: technology and human resources. If your technology leadership was prepared and systems were capable of the massive transition to remote work, then technology was celebrated. If your technology was not up to par, it was obvious. The criticality of HR during 2020 was just as great. HR had to transition nearly an entire workforce to a virtual one, while ensuring employees were productive. They dealt with virtual recruiting and virtual onboarding and sought to sustain employee satisfaction and engagement while working from home. Not everyone has a home office or day care for their children. Often, these employees felt completely stressed out, and it was HR’s role to ensure programs were in place to support them. Many businesses leveraged remote technologies to allow for more flexible and productive work arrangements and to create a new normal for the way employees approached their work.

%

M+B searches were completed 20% faster

From an executive search standpoint, we were able to conduct executive searches at a faster pace because our clients were comfortable being more flexible with interviewing. Executive team interviews that had been conducted in person throughout an entire day were now being accommodated and scheduled remotely. For example, the same four people could interview a candidate when convenient. Thus, scheduling didn’t become the bottleneck. As a result, we completed our searches nearly 20% faster.

Financial Services Hiring Grows

Regardless of all the internal or external factors at play, the goal in any executive leadership search remains the same: to find the best candidate who aligns technically and culturally. Our job is to identify a slate of candidates from our strategic pool of targeted prospects to compare and contrast and ultimately find the ideal fit — someone who is interested, available, affordable, and adaptable.

Where CFIs Conducted Searches

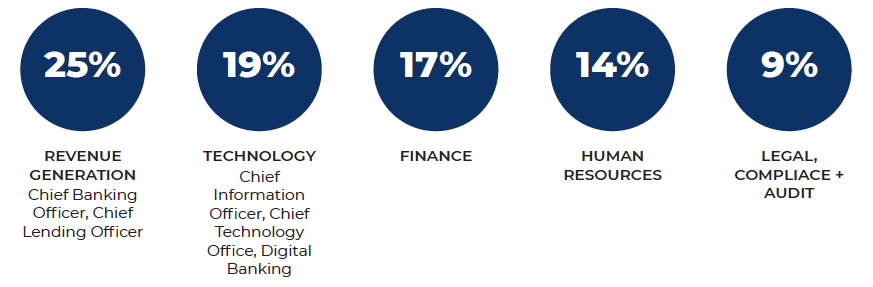

While executive searches were down across all industries last year, our Financial Services Practice grew by 18% over 2019. The two largest drivers were succession planning and diversity and inclusion. Our five most prevalent functional verticals for searches were:

A Willingness to Relocate

Aside from geographic specific searches (for example, a Market President), every search was run on a nationwide basis. One in every three hires were long-distance relocations. Many candidates in major metropolitan areas were excited about the possibility of moving to a suburban location. Those candidates in suburban areas could take advantage of a hot real estate market for sellers as urbanites relocated to residential neighborhoods.

The Importance of Long-Term Incentives

Long-term incentives continue to be key differentiators in compensation packages. These come in all shapes and sizes, whether as equity, split-dollar life insurance plans, or deferred compensation plans. Organizations that offer these incentives continue to have an advantage in recruiting. As more and more organizations put long-term incentive plans in place, candidates have become accustomed to receiving them as part of their compensation package.

Comfort With Out-of-Industry Candidates

Our clients demonstrated a greater willingness than ever to look for strong talent outside of the financial services industry — with the exception of credit and lending roles, which require prior banking experience. Over a quarter of the candidates came from outside the industry. As organizations look to infuse innovative thinking into the boardroom, bringing on executives with diverse backgrounds is paramount. Within financial services there is still an underrepresentation of certain minorities, such as women, Blacks, Hispanics, veterans, disabled people, and LGBTQ. Yet, 52% of our searches were filled with diversity candidates.

%

of M+B searches were filled with diversity candidates

Looking Ahead

As we continue to deal with the pandemic, the outlook for 2021 looks brighter with consumer confidence trending upwards and vaccines being administered. We hope to return to a semblance of normality within the next few quarters. In their 2021 outlook, the economics team at Morgan Stanley Research says a V-shaped recovery is now entering a new self-sustaining phase and is on track to deliver strong global GDP growth of 6.4% for 2021. The unemployment rate is expected to end 2021 at 6.25%.

We anticipate succession to continue to be the number one driver for executive-level hiring as executives at community financial institutions retire and look to elevate talent in their place. Searches within the technology function have been the highest concentration in the last five years for us, and I don’t see that slowing down any time soon. As banks and credit unions consider themselves to be fintechs with deposit capabilities, the need for digital innovation will continue to grow. As confident as we are, we do see some more bank consolidation in the future. Larger organizations come with regulatory burdens, so compliance, risk, and legal will likely continue to be areas of focus for our clients as well.

About the Author

Brandon Biegenzahn

President

biegenzahn@mbexec.com

Brandon Biegenzahn is the President of McDermott + Bull and the chair of the firm’s Financial Services Practice Group. Brandon is a corporate attorney who practiced with Sheppard, Mullin, Richter & Hampton, and Buchalter Nemer in their corporate finance departments. Brandon received his Bachelor of Arts from the University of Southern California and his Juris Doctorate from Penn State.