Who + Why

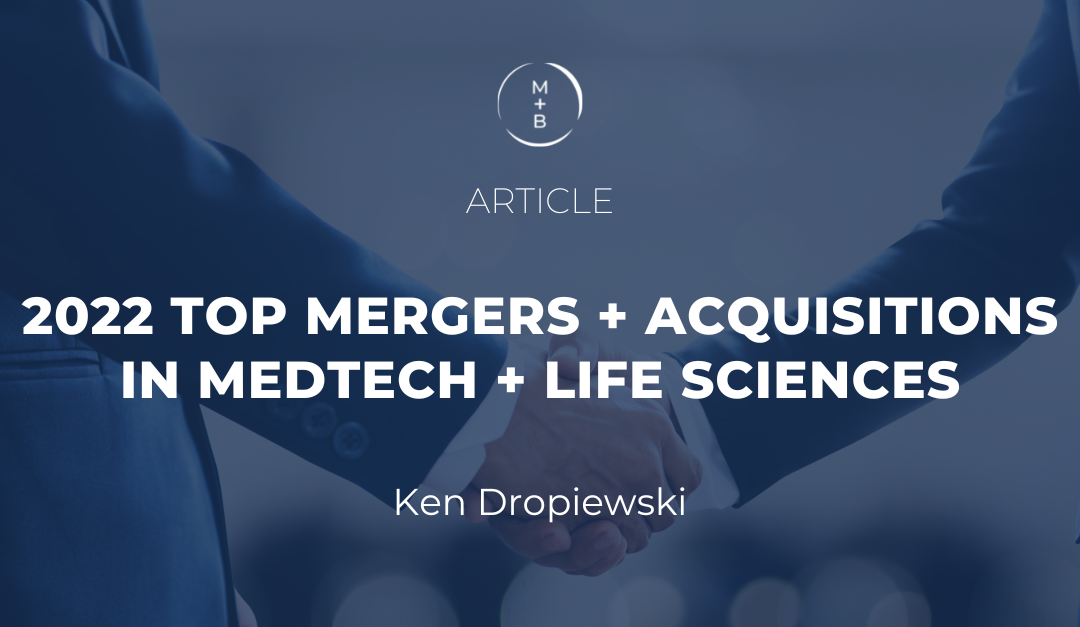

Several big companies started the year by saying they planned on being aggressive with acquisitions in 2022. That didn’t materialize. In fact, MedTech acquisitions were down 85% in the first half of the year compared to 2021. Although, there seems to be some activity picking up in the second half of the year (see the list below).

I’m keeping a close eye on valuations. So far, they seem to be doing okay, but the future is ambiguous. For now, let’s celebrate what happened this year. With that being said, here are my top five mergers + acquisitions for 2022 in chronological order.

My Top 5 Mergers and Acquisitions in the MedTech/Biotech Industry for 2022

1. Oracle Acquires Cerner ($28 Billion Value)

2. Stryker Acquires Vocera Communications ($3 Billion Value)

“This acquisition underscores our commitment and focus on our customer. Vocera will help Stryker significantly accelerate our digital aspirations to improve the lives of caregivers and patients.2”

3. Thermo Fisher Buys The Binding Site ($2.6 Billion Value)

4. Bain Capital Buys Olympus Science-Optics Unit ($3 Billion)

5. Johnson & Johnson Buys Abiomed ($16.6 Billion)

“We have committed to enhancing our position in MedTech by entering high-growth segments. The addition of Abiomed provides a strategic platform to advance breakthrough treatments in cardiovascular disease and helps more patients around the world while driving value for our shareholders.5”

In Conclusion

Partner

dropiewski@mbexec.com

Ken Dropiewski is a Partner with McDermott + Bull’s Life Science and Medical Device practice and has been in the search industry for nearly two decades. Ken and his team Shelby Varon, Director, and Allison Cox, Senior Executive Recruiter, serve the medical device, biotechnology, and healthcare industries. Ken is especially known for his work in the cardiac, vascular, and interventional oncology segments and has been in the MedTech field for over 20 years. Before his career in executive search, he worked for Johnson & Johnson and Boston Scientific.

(2) https://www.vocera.com/press-release/stryker-announces-definitive-agreement-acquire-vocera-communications

(3) https://www.reuters.com/markets/deals/thermo-fisher-buy-diagnostics-firm-binding-site-26-bln-2022-10-31/

(4) https://www.dotmed.com/news/story/58701

(5) https://www.prnewswire.com/news-releases/jazz-pharmaceuticals-completes-acquisition-of-gw-pharmaceuticals-plc-301284512.html