MEDTECH + LIFE SCIENCES OUTLOOK IN 2023

2022 was an interesting year, to say the least. It was the tale of two markets. After the extremely volatile years of 2020 and 2021, no one could have predicted the sheer amount of momentum that lay ahead in 2022.

The economy continued to soar, consumers were spending, procedures unrelated to the COVID-19 pandemic climbed at hospitals, and it was hard to find talent to meet market demand. The second half of the year started to shift and, by the fourth quarter, things drastically changed. Most of this was driven by events that hit the economy from various sides. Some of the more obvious components included rising prices from supply and demand issues, the invasion of Ukraine by Russia, and the fact that we’re still dealing with the COVID-19 pandemic – albeit on a smaller scale. On top of this, depending on who you listen to, we’re at risk of entering a recession. The J.P. Morgan Market Outlook report, given on January 5, 2023, states that the global economy may not head into a recession, but that the U.S. may well be in one by year’s end. Many economic experts predict that rate hikes will pause by year’s end as well. Additionally, J.P. Morgan expects modest Global GDP growth of 1.6% in 2023, with the U.S. growing at 1.0%.

In this piece, we will reflect on hiring trends from last year that will carry into 2023, highlight areas of preparation, and explain ways to think about addressing challenges in the labor market.

MARKET TRENDS IN EXECUTIVE HIRING

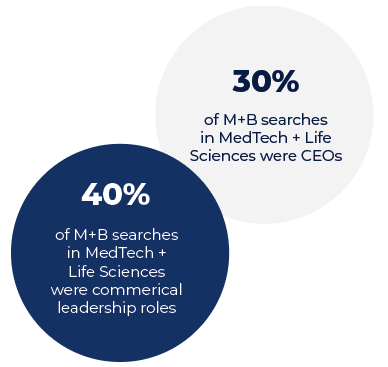

Our practice mostly worked with MedTech and Life Sciences companies in 2022, performing executive searches in various functions, including commercial leadership, operations, finance, clinical work, and more. Commercial leadership roles accounted for 40% of our searches last year. Chief Executive Officer replacement roles were strong, climbing to 30% of our searches. Over half of our searches were private equity-sponsored or venture capital-backed growth companies.

I’ve listed additional notable trends related to our MedTech and Life Sciences clients.

55% of the companies we partnered with offered remote or hybrid opportunities. Positions with more stringent in-office requirements took 16.7% more time to fill.

Compensation packages rose between 12% and 17% for most of the candidates placed. Equity played a heavier role for private companies that couldn’t match bigger companies’ cash compensation.

Bigger companies held salaries flat but increased back-end potential. Smaller or riskier companies had to dig for higher salaries or guarantees to offset risk and competing on-track earnings opportunities with less equity potential.

LABOR MARKET

We started 2022 with a very tight labor market and it stayed that way for most of the first half of the year, though it does seem to be softening a little. Even though it has eased some, it remains a challenge to attract the right talent. A lot of top talent left their positions and capitalized on higher equity opportunities over the last year and a half, and they aren’t ready to look at new opportunities so soon. Their counterparts who remained loyal are expecting the same elevated compensation opportunities despite changes in the market. The current market conditions are also making top candidates more risk-averse, causing them to take more of a “wait and see” posture. As a result, we will have to talk with a lot more people to satisfy our clients’ needs in the coming year.

DEMAND FOR DIVERSITY + INCLUSION CONTINUES

Diversity and inclusion have been buzzwords within corporate circles for years, and McDermott + Bull continues to push the envelope. No longer are these words catchphrases, they are business imperatives. We recognize that diversity and inclusion are always one of the top three objectives of our clients when conducting an executive search. In 2022, 51% of our candidates placed were representative of a diverse workforce.

Now more than ever, we are seeing candidates demanding to work for companies that not only speak about their commitment to diversity and inclusion, but that also demonstrate it in their hiring tactics. Candidates seek for institutions that have diverse employee populations and are progressive about bringing diversity of thought into the boardroom.

%

of M+B candidates placed in 2022 were diverse

HOW COMPANIES ARE PREPARING

While the topics discussed may seem overwhelming, I don’t believe they are as dire as they may appear. While the prospect of greener pastures sounds interesting, many people are genuinely happy right where they are. So, keep them that way. Let them know they are valued and keep them busy.

Compensation

Run annual compensation surveys to understand the market and maintain a competitive edge. Look at your peers, but remember that the definition of a peer is changing. Peers may no longer be the institutions that look just like you. In fact, they likely aren’t.

Be Intentional about Interpersonal Relationships

With remote work environments, people lose touch and company-wide culture is difficult to establish and maintain, at least in the traditional manner of water cooler talk or grabbing a drink after work. However, you can still create unique moments to bring your people together and ensure that they have time together in person.

Flexible Work Arrangements

I’m one of the few individuals who prefer to shower, get dressed, and go to the office, but flexibility reigns. If you want people in the office because you like having people around, that is the wrong reason. Look at productivity. If it’s high when working remotely, keep arrangements that way or at least offer remote work opportunities. To make this easier to stomach, clients of ours who offer fully remote work arrangements can attract talent at a lower price because the ability to work remotely is a currency in and of itself. In fact, some initial data we are collecting show that it is more expensive to obtain a candidate locally.

Change is always difficult, but it is frequently accompanied by positive progress. With respect to talent attraction and retention, here’s to adaptation and advancement.

IN CONCLUSION

All things considered, McDermott + Bull fared well compared to many other organizations in 2022. The MedTech and Life Science Practice is growing at our firm, and it is a trend we anticipate continuing. As the firm’s partner in this niche, I look forward to serving you and continuing to see this segment grow for the greater good of patients across the globe.

Ken Dropiewski

Partner

dropiewski@mbexec.com

Ken Dropiewski is a Partner with McDermott + Bull’s MedTech and Life Sciences Practice and has been doing search for nearly two decades. His expertise serves the medical device, biotechnology, and healthcare industry. Ken is especially known for work done in the cardiac, vascular, interventional, and oncology segments and has been in the MedTech field for 30 years. Prior to his career in search, he spent time at Johnson + Johnson and Boston Scientific.