I must admit that I have the most interesting job. I spend my time speaking to fascinating people all day long – CEOs, CFOs, Chief People Officers, Senior Sales and Marketing Officers, and Partners and Principals of private equity firms among many others. As we approach the mid-point of Q4, regardless of the reason for the conversation, similar questions almost always come up: what are we sensing about the economy and, by association, what are others around us sensing? Is the talent market softening? Where has all the talent gone?

Where Have All the Baristas Gone?

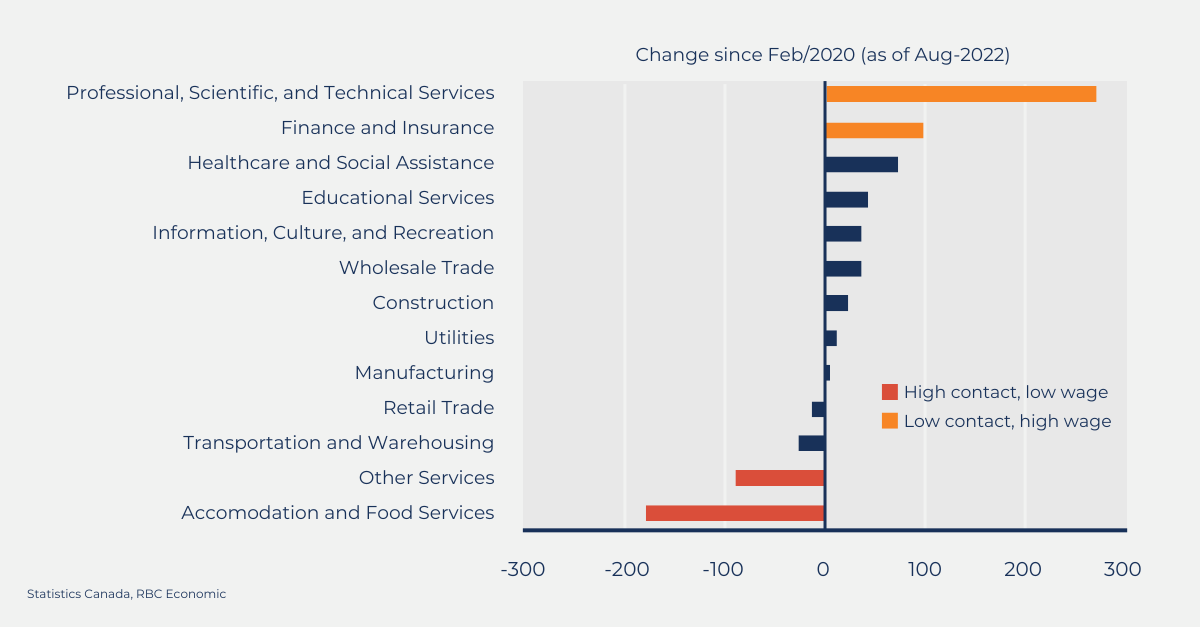

At a conference I attended recently, a Senior Director of Economics from the Royal Bank of Canada produced some very insightful statistics. One of the more illustrative graphs from this presentation is included below, showing the change in sectoral employment from February 2020 until August 2022 – so, that’s where all the baristas have gone.

The Canary in the Coal Mine

On the opposite side of the cycle, when the economy begins to exit a trough, our phones often begin to ring prior to the turn, as companies begin to execute their often-pent-up talent plans.

So, yes, here at McDermott + Bull, we can predict the future. Maybe not quite, but the phones are still ringing. The North American executive search business is up quarter over quarter, year-to-date, and over the same quarter last year.

I attended a global private equity (PE) and venture capital (VC) talent conference in San Francisco during September. The attendees included talent experts from, and individuals supporting, the PE and VC industries. The overwhelming sense was a sense of…overwhelm. Demand for leadership talent has not abated in the face of perceived economic headwinds. Over the past four months, members of our team have attended conferences in the medical device, aerospace, food and beverage, and VC or PE industries. The general consensus has been the same.

Takeaways

As you build out or modify your strategic growth plan, overlay your people plan to ensure that these align.

If your team is wavering on filling a particular “mission critical” role, ask them, “what happens if we don’t fill this position?”

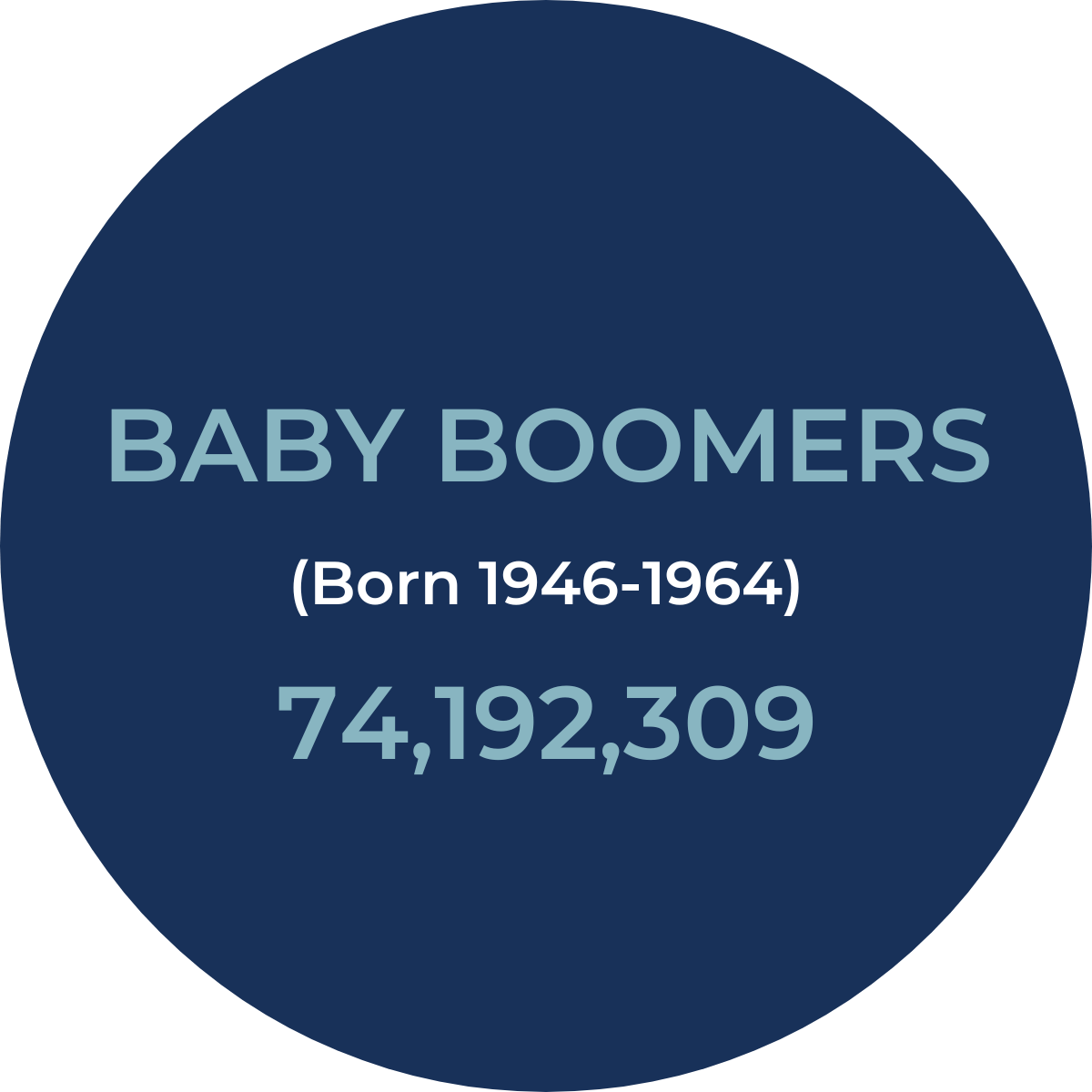

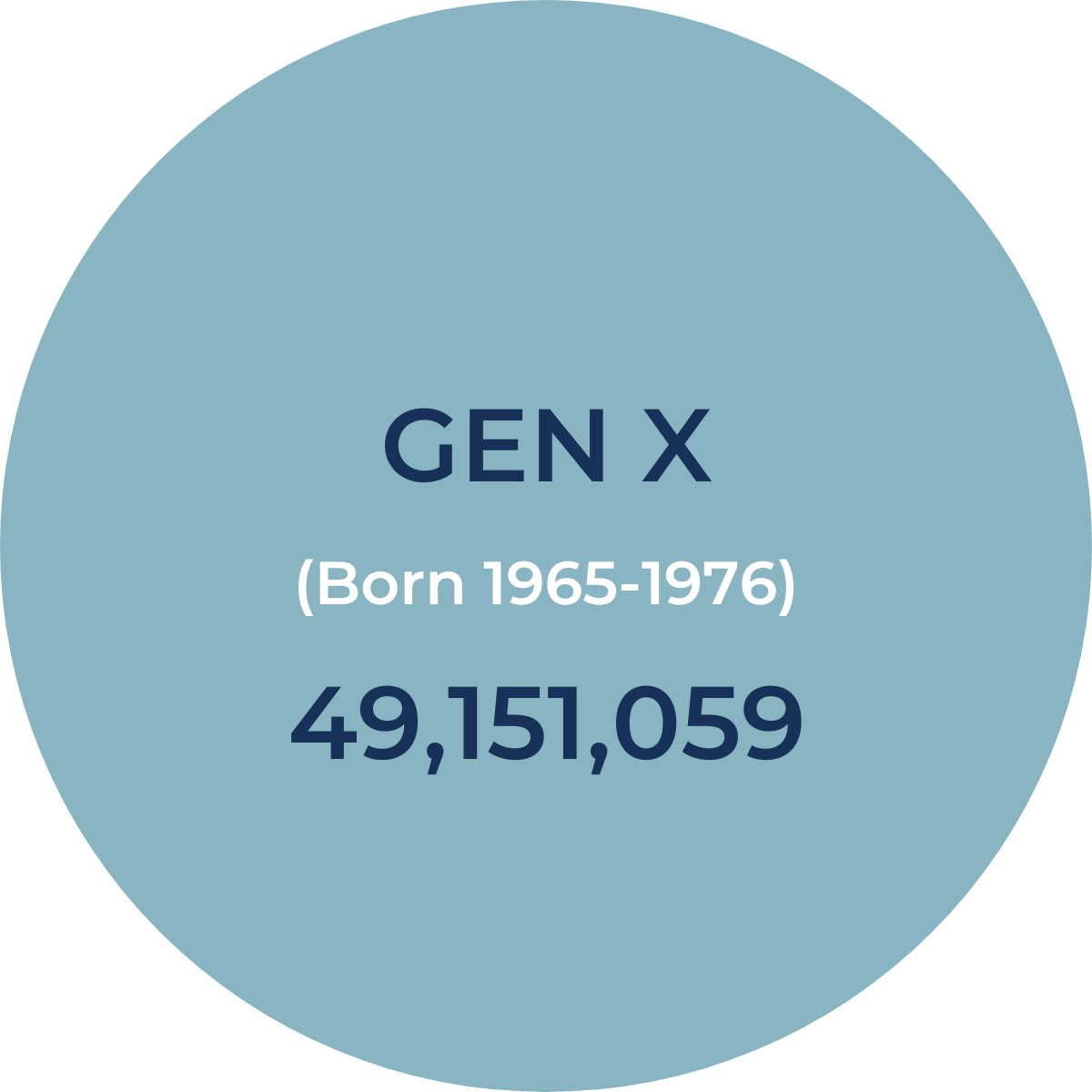

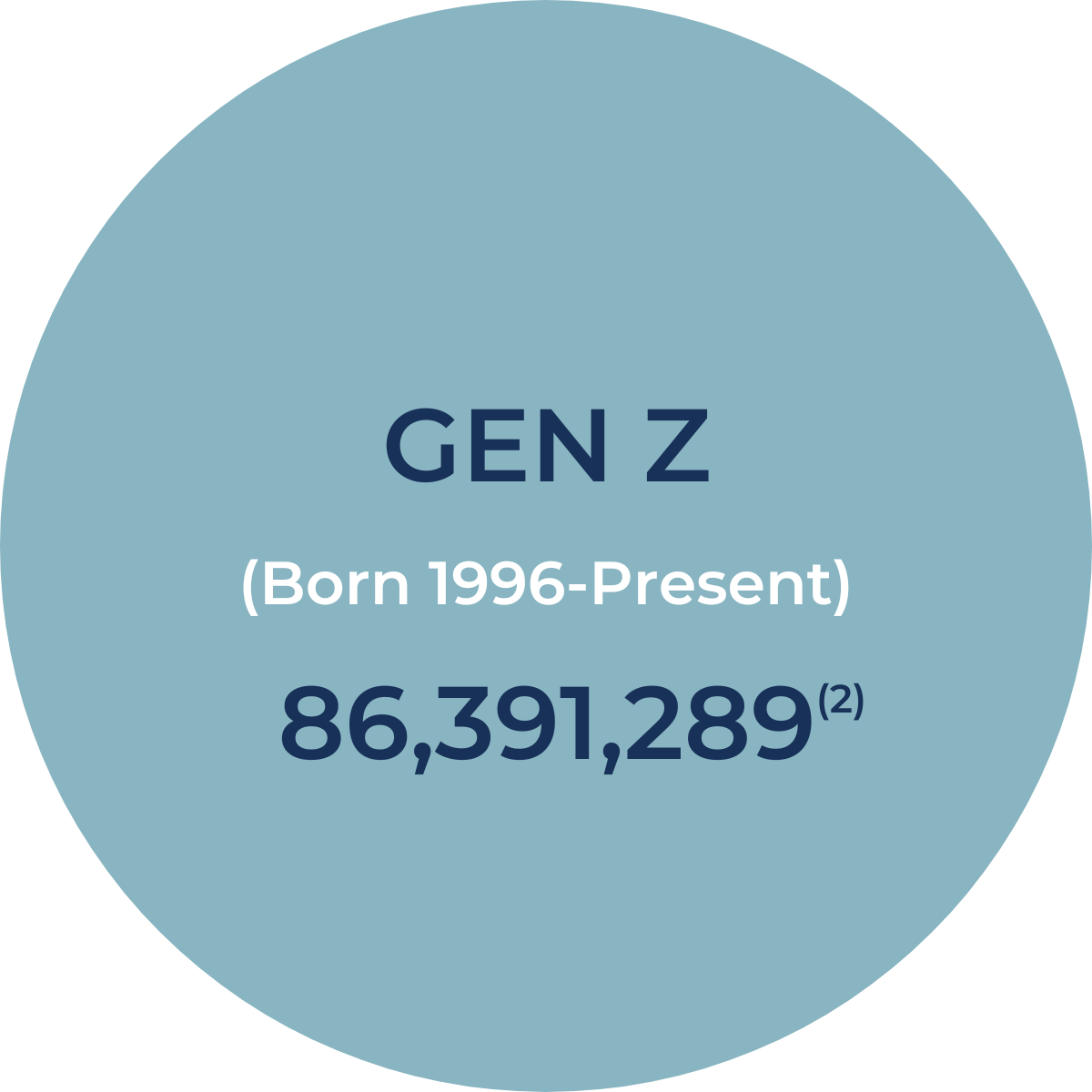

Given the demographic tide (see below), lean toward filling the role as it could take longer than it did previously.

Waves Versus the Tide

The talent marketplace is like the ocean; the tide impacts the direction of the ocean regardless of what the waves are doing.

The tide of demographics is pushing the marketplace toward a scarce leadership market for what may be the next 10 years, regardless of economic gyrations. Boomers are talking about their relationships with work, and Gen X, the cohort right behind the boomers, is comparatively small.

Takeaways

From a board perspective, ensure your Chief Executive Officer is developing a robust, succession-oriented team and continually transferring knowledge. Can you measure and compensate for this?

About the Author

Dan O’Day

Partner

doday@mbexec.ca

Dan serves as a Partner at McDermott + Bull, based in the firm’s Vancouver office. He has 20+ years of search experience across a range of industries, including healthcare and life sciences, consumer goods, and food and beverage. In his practice, Dan partners with private equity firms and their holding companies along with public and private companies to assist them in sourcing and engaging key executive talent nationwide.

Citations

CGK, T. (2022, July 23). How large is each generation in the US? The Center For Generational Kinetics. Retrieved November 21, 2022, from https://genhq.com/large-generation-us/#:~:text=Millennials%20(Born%201977%20to%201995,Born%201945%20and%20Before)%20%3D%2029%2C936%2C901

Kornferry. (2020, January 21). Age and tenure in the C-suite. Korn Ferry. Retrieved November 21, 2022, from https://www.kornferry.com/about-us/press/age-and-tenure-in-the-c-suite

ShareAmerica. (2016, March 31). Idiom in the news: Canary in the coal mine. ShareAmerica. Retrieved November 21, 2022, from https://share.america.gov/english-idiom-canary-coal-mine/