2021 brought about a massive groundswell of executive-level search activity, caused by the perfect storm of market factors — a nearly immediate halt of economic activity, followed by a rapid rebound, and a shift in leadership competencies needed to succeed in our new normal.

Across all industries, the volume of executive-level searches (SVP and above) increased by 60% over 2020. Within the financial services sector, the increase was not as great year over year and that is because demand never waned in 2020 — it actually increased over prior years. McDermott + Bull’s Financial Services Practice saw an increase of 36% in volume of searches in 2021 compared to 2020.

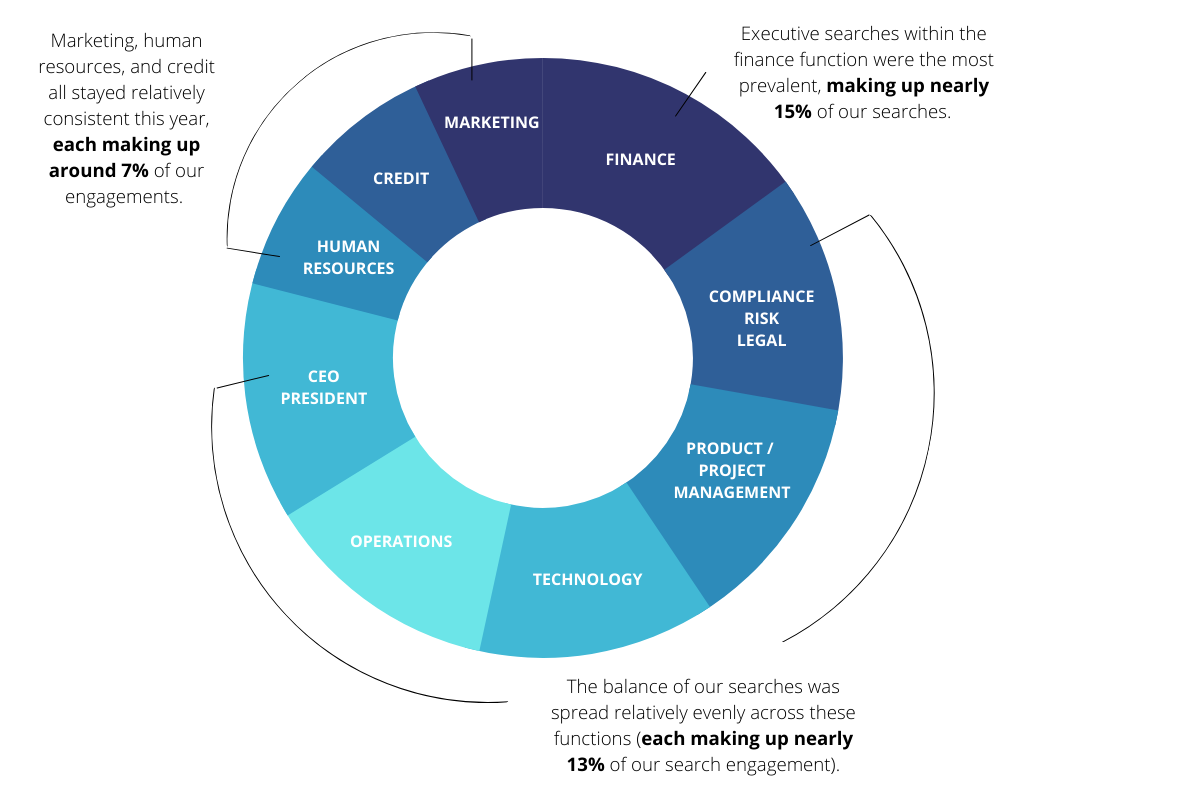

Below are the key statistics from the Financial Services Practice in 2021. The practice serves small and mid-cap financial institutions including banks, credit unions, fintechs, and investment banks.

%

2021 Financial Services Practice Increase in Volume of Searches Compared to 2020

Key Takeaways

We filled more of the top two roles (Chief Executive Officer/President and Chief Operating Officer) this year than in any year in the preceding decade.

We believe that our clients are seeking diversity of thought and fresh ideas with these hires as we are seeing more organizations look externally to fill these roles.

This is a candidate's market.

Remote work has a massive premium to candidates. The pandemic has brought about an entirely new way of conducting business, with many companies operating with a “distributed workforce” model, or put another way — work from anywhere. We have found that remote work, defined as working outside the office a majority of the time, is now (and perhaps has always been) a massive currency for people.

Compensation figures are on the rise. We are seeing a snowball effect that is driving the candidate’s market. Meaning, if a company won’t offer remote work, they are forced to increase pay. With such a demand for talent, companies that are willing to offer remote work are also matching increased compensation. With so few viable candidates, companies are forced to look beyond industry lines, thus causing cross-industry norms to be adopted when they historically were not.

How long will it last?

Though it may prove impossible to forecast, I believe the demand for talent will be with us for the next five years. Pandemic or not, boomers are going to continue to retire. Additionally, the easing of formal working arrangements is our new normal – I believe it will not change. As big companies across industries shut down their management training programs, those early in their careers get trained in specialized verticals, but not across the organization. Thus, leaders who truly understand the totality of a business will be fewer and farther between. I forecast that demand will increase, perhaps exponentially.

About the Author

Brandon Biegenzahn

President

biegenzahn@mbexec.com

Brandon holds dual roles as President of McDermott + Bull and Chair of the firm’s Financial Services Practice. As President of McDermott + Bull, Brandon leads day-to-day operations for the firm as well as the strategic buildout of the firm’s team of executive search managing directors. As Chair of the firm’s Financial Services Practice Group, he is a partner to an array of financial services firms, including investment banks, commercial banks, private banks, credit unions, asset managers, institutional investors, and fintech companies.