2022 – the Peak and the Valley

Financial Services Still Riding a High

Within the small- and mid-cap financial services sector, demand has remained relatively consistent since the beginning of 2021. While the search demand has remained consistent, we have seen increased revenue driven by increased compensation packages.

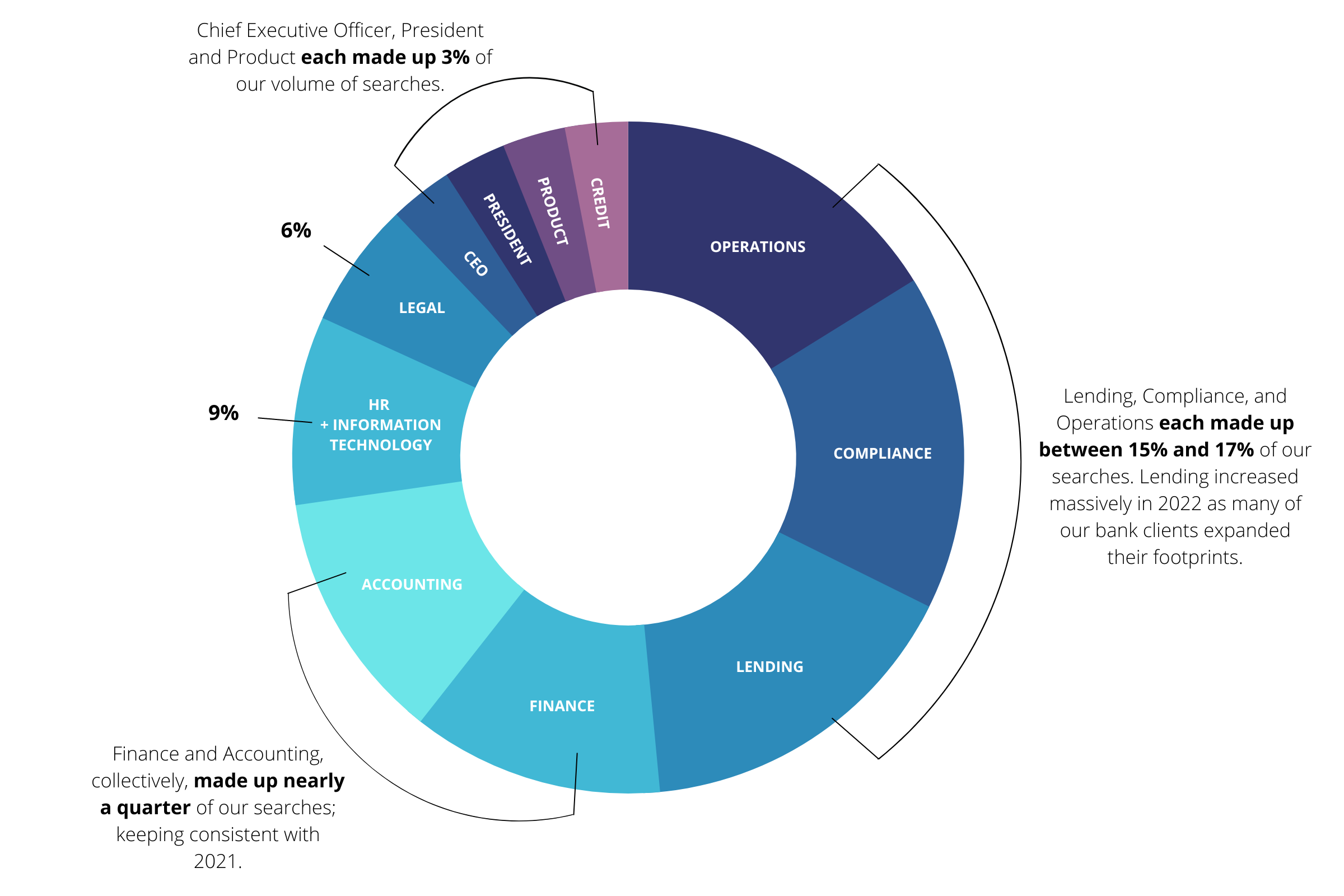

Below are the key statistics from the Financial Services Practice in 2022. The practice serves small- and mid-cap financial institutions including banks, credit unions, financial technologies, and investment banks.

Key Takeaways

Remote and Hybrid Working Environments – A Currency for Candidates and a Cost-Savings for Employers (Although Our Clients are Clamoring for More Return to Work)

Compensation – On the Rise

Cross referencing McDermott + Bull’s data with that of McKinsey and Thrive, we can triangulate that

30% compensation increase

Nearly one-third of job-changers at the executive level are seeing a compensation increase of 30%, with an average increase of 24%.

13% Premium on in-market candidates versus out-of-state

22% Premium on “Large Company” Candidates

What Does the Future Hold?

While the Financial Services sector has not yet been impacted by the hiring slow down, it undoubtedly will. We see Human Resources, Marketing, and Product departments as the three functional verticals that will experience the deepest cuts and the greatest slowdown in demand. Financial services, in general, has not lost as many people to other industries and is retaining its talent. However, we continue to see that talent move within the industry.

Two states we serve heavily are California and Washington, and both have seen consecutive years of population decline. Texas, Florida, North Carolina, and South Carolina have seen growth for years, but even in the West, we’re seeing transplants move to Idaho and Nevada where they will experience cost of living decreases and corresponding increases in quality of life.

What can our clients do:

Align compensation offers with the market standard

Find avenues to accommodate flexible working arrangements

Ensure high-potential employees have career maps and see opportunities for advancement

About the Author

Brandon Biegenzahn

President

biegenzahn@mbexec.com

Brandon holds dual roles as President of McDermott + Bull and Chair of the firm’s Financial Services Practice. As President of McDermott + Bull, Brandon leads day-to-day operations for the firm as well as the strategic buildout of the firm’s team of executive search managing directors. As Chair of the firm’s Financial Services Practice Group, he is a partner to an array of financial services firms, including investment banks, commercial banks, private banks, credit unions, asset managers, institutional investors, and fintech companies.