The commercial real estate industry continues to evolve in a post-pandemic world and 2023 is shaping up to be an interesting year. Here are four industry trends we are keeping an eye on, including the potential for a revitalized approach to brick-and-mortar retail and the continued push to make commercial buildings more environmentally sustainable.

Interest Rates Rise While Loan Maturities Loom

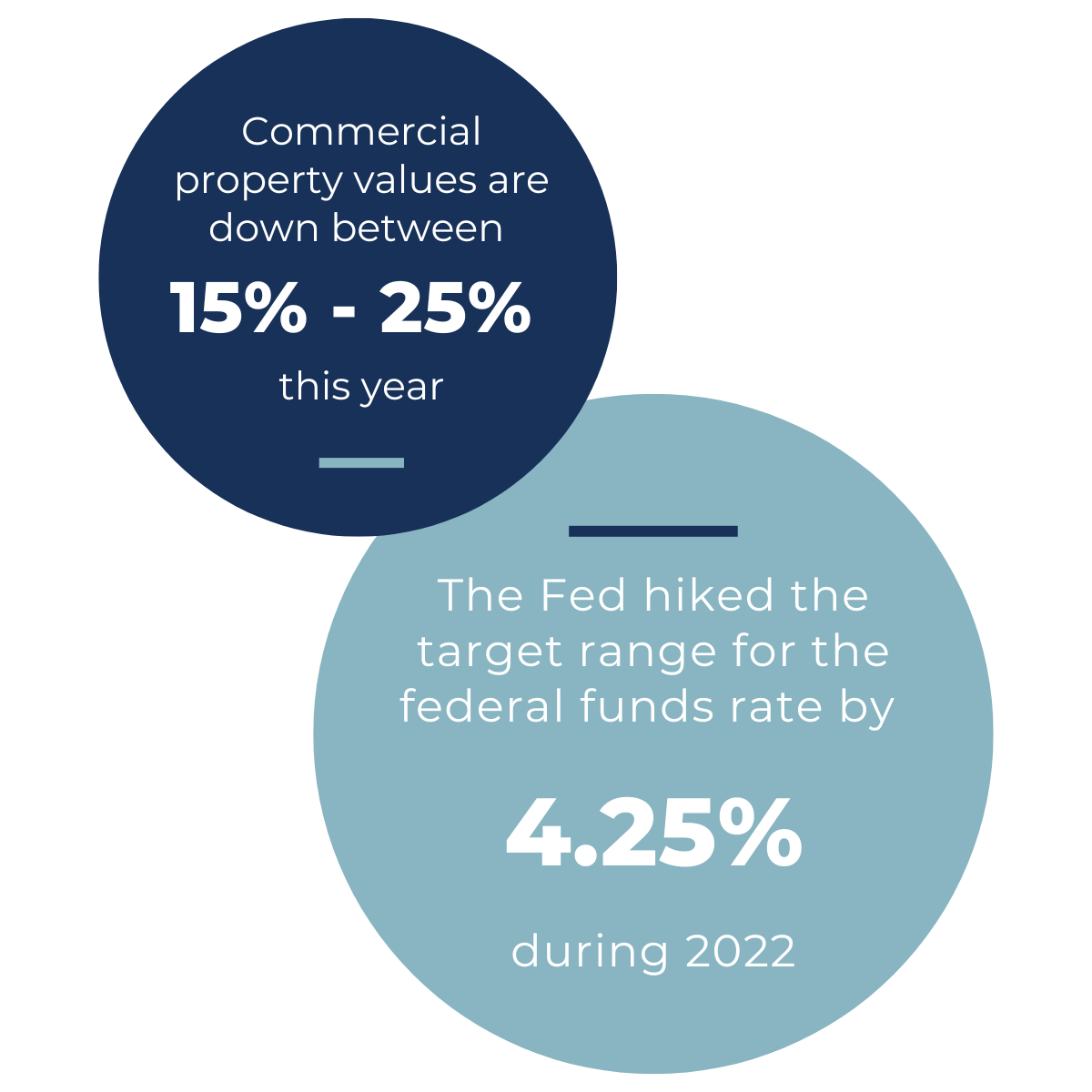

The Federal Reserve is expected to keep interest rates up until we see a sustained ease in inflation. The Fed hiked the target range for the federal funds rate by 4.25% during 2022. Most pundits anticipate additional increases in 2023, with the expectation that we’ll see the federal funds rate hit 5% before the end of the year.

Higher interest rates to borrow money, widening cap rates, and the slowing of rent growth will continue to depress commercial property values this year, which are down between 15% – 25%. All of these economic issues are converging during a year when Trepp estimates $447 billion of commercial mortgages are coming due, with another $486 billion in 2024.

Borrowers will likely need to inject additional equity to refinance their loans, which means they may need to raise new JV equity or find alternate forms of capital sources. Others may choose to default and walk away from their property. December 2022 saw the first increase in nearly a year in Fitch Rating’s U.S. CMBS delinquency rate, mainly driven by single asset, single borrower (SASB) multifamily loans defaulting at maturity.

Office 2.0

The trend we are seeing is that employees do want to return to the office, but with hybrid schedules. Companies that embrace flexibility seem to be winning the talent game, as we reported in Q3.

With office vacancy at 17.1% nationally, the question is what types of office space are in demand and being utilized? Tenants are seeking well-located, quality buildings with high-end amenities — fitness centers, outdoor spaces, food and beverage options — that engage employees, create an experience, and enhance well-being. Because of this, Class A and trophy buildings should continue to attract new leases while secondary, dated buildings will struggle to retain existing tenants or attract new ones.

Class B and C buildings will need to upgrade or face the potential of becoming obsolete. Owners with undesirable spaces may find themselves defaulting on their loans, causing more distressed assets to hit the market in 2023. Well-capitalized investors will eye these assets, most likely with plans to convert them into different uses.

The ability and success of conversion will vary depending on location, floor plates, ceiling heights, light access, plumbing, and other infrastructure. Cities with a shortage of affordable housing may consider tax incentives and credits to encourage developers to convert office space to multifamily. It’ll be interesting to see how this plays out in older cities like New York and Boston.

Retail’s Resurgence

The COVID-19 pandemic really highlighted the value of grocery-anchored shopping centers, which historically have been able to withstand an economic downturn with stable rents because the tenants of these centers are typically necessary community staples.

According to the real estate firm JLL, grocery-anchored retail posted a second consecutive record year with roughly $14.7 billion in total transaction volume (30.5% of all sales by volume). This was a nearly 15.6% increase over 2021. While the pandemic saw the temporary rise of e-commerce grocery sales, more shoppers are heading back to the store. As such, we should see investors increase capital allocation into grocery-anchored retail.

%

Grocery-anchored retail saw a 15.6% increase in total transaction volume over 2021

The overall retail market also looks to bounce back after a few rocky years during the pandemic. According to Deloitte, the focus for retailers in 2023 will be to drive more profit from curated experiences, to seek innovation and improvement in last-mile delivery options, and to increase conveniences for consumers. For example, consumers want a seamless shopping experience across multiple channels, such as online ordering for convenient in-person pick up.

The Rise of ESG

The Securities and Exchange Commission is expected to issue new regulations for disclosing climate risk for public companies. This could have a profound effect on the commercial real estate industry’s contractors, as more companies with real estate assets will have to examine their suppliers and vendors.

According to CBRE, tenants are also keen on ESG when looking at prospective office space. They see the value in energy savings and “greenness,” while realizing increased productivity from the workforce with health- and wellness-focused amenities. Meanwhile, owners benefit from higher asset value and more stable, premium rents.

With attention on ESG, many owners of secondary buildings will be forced to upgrade their infrastructure. In New York, Local Law 97 requires 50,000 buildings of more than 25,000 square feet to cut their greenhouse gas emissions by 40% by the end of this decade, with a target of 2050 for net zero emissions.

Depending on the building and the financial health of the owner, the improvements needed to comply may be too costly for their balance sheet. They may be forced to take out more loans and look for outside capital sources to fund green upgrades. Some may look to commercial property-assessed clean energy financing from the U.S. Department of Energy. Others may just opt to pay the fines until they can sell the building.

With these trends growing throughout the commercial real estate industry, we can expect a unique year in the space. What are you keeping an eye on in 2023? I’d love to hear from you.

Partner

sdeswaan@mbexec.com

Sun-Sun de Swaan serves as a Partner at McDermott + Bull in the New York office where she leads the firm’s real estate practice. Sun-Sun brings over 20 years of real estate experience and works with clients across the sector, including firms involved with investment, development, financing, and property management. She has experience in a variety of functions across the industry, shaping her expertise and ability to deliver best-in-class talent to clients across the board.