The Company

Industry: Credit Union

Entity Type: Private

Operating Region: Southern California

Size: $150M

The PROBLEM

The credit union’s CEO suddenly retired before their scheduled exam with the NCUA. The organization needed an executive to lead them through the exam and upgrade their commercial lending policies and procedures.

The Solution

McDermott + Bull Interim Leaders brought in a CEO with deep experience as a Chief Lending Officer in the credit union industry and a strong background in commercial lending.

The RESULT

The consultant applied their commercial lending expertise to examine the loan portfolio, enhance policies and procedures, and provide stable leadership and mentorship to the institution. Additionally, they grew their commercial real estate loan portfolio, focusing on initiating new potential loans and business development.

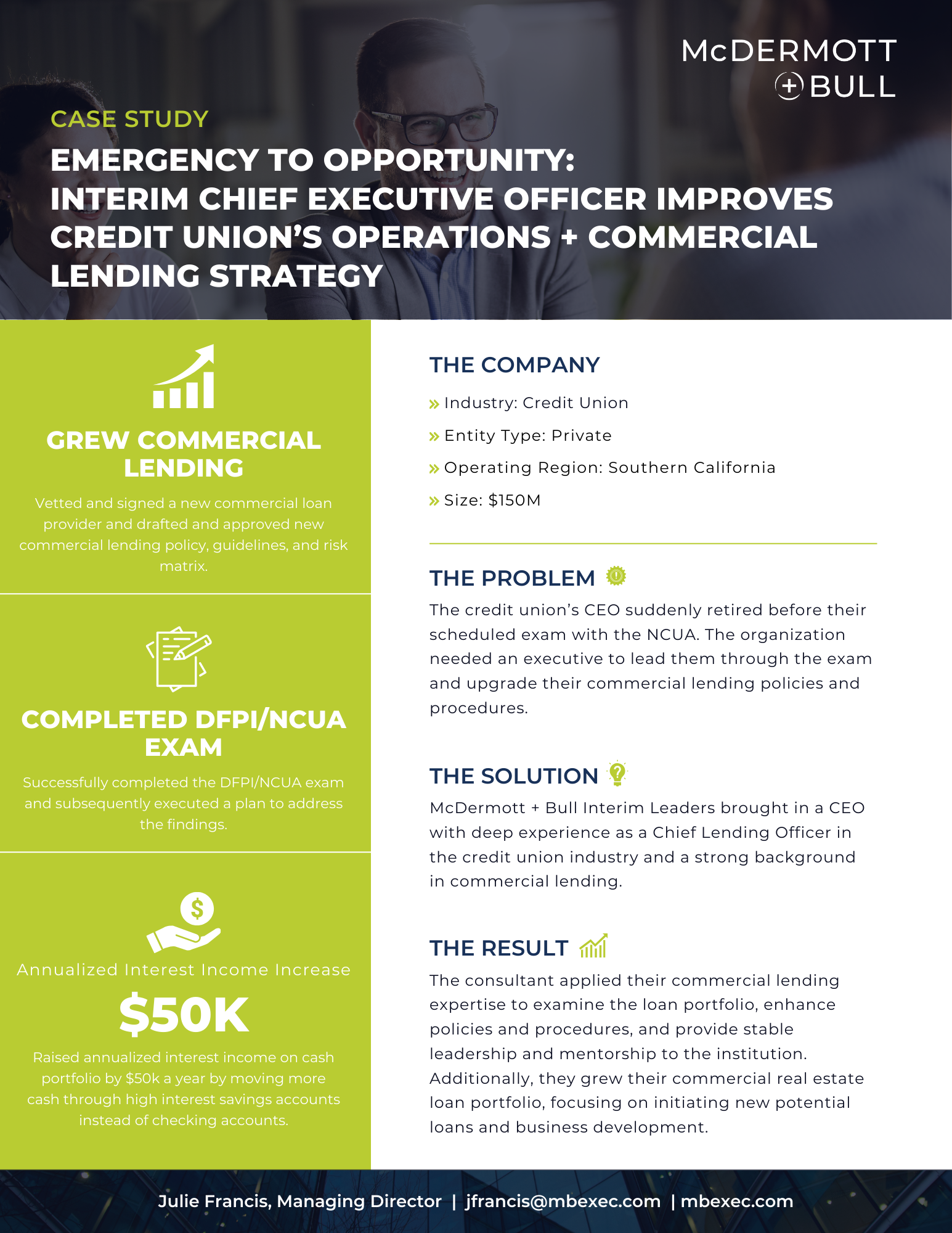

Grew Commercial Lending

Vetted and signed a new commercial loan provider and drafted and approved new commercial lending policy, guidelines, and risk matrix.

Completed DFPI/NCUA Exam

Successfully completed the DFPI/NCUA exam and subsequently executed a plan to address the findings.

Increased annualized interest income by $50K per year

Raised annualized interest income on cash portfolio by $50k a year by moving more cash through high interest savings accounts instead of checking accounts.

Julie Francis

Managing Director, McDermott + Bull Interim Leaders

jfrancis@mbexec.com

Julie Francis serves as Managing Director for McDermott + Bull Interim Leaders, where she identifies and secures highly skilled executives to address critical business challenges, provide interim leadership, and oversee special projects. She works with executive leadership at middle-market and enterprise-level companies as well as with investment banks and private equity groups to improve operational and financial performance.