Herein, you will find a lookback on the previous 12 months of executive hiring and mobility within community and regional banks (up to $100 billion in assets) across the U.S., as well as within McDermott + Bull’s financial services practice. In addition to bank data, you will also find a cross-pollination with credit union metrics to provide the most comprehensive overview of the market.

Executive Summary

As has been well documented, our industry continues to experience meaningful leadership turnover as long-standing executives retire, and institutions evolve to meet new operating realities. Across community and regional financial institutions, executive transitions remained active throughout 2025, but the conditions required to hire externally became more specific, more competitive, and less forgiving of misalignment. The findings below summarize what changed in bank executive hiring and mobility and how institutions can optimize hiring outcomes in 2026 and beyond.

Executive Mobility: External Hires are Driving Change

Nationally, bank executive movement leaned toward external hiring in 2025. Approximately 57.5% of executive transitions reflected external hires, while 42.5% were internal promotions or internal transfers. This demonstrates a willingness among banks to look outside the organization for leadership talent, whether to introduce new capabilities, accelerate transformation, or fill gaps where internal succession is not as readily available.

External hiring is therefore not simply an extension of internal succession; it is a different market dynamic. The strongest candidates are typically passive, and competitive processes are won by institutions that are clear about the mandate, fast in decision-making, and realistic on total compensation.

Where We Saw Executive Hiring Concentration

Across both national movement patterns and as reflected in McDermott + Bull’s body of work, executive demand concentrated in a predictable set of functions tied to performance, risk, and modernization. On a national basis, Lending, Compliance/Risk, and Technology accounted for a significant share of leadership movement within banks. These are the functions most directly connected to growth outcomes, regulatory expectations, operating efficiency, digital experience, and resilience.

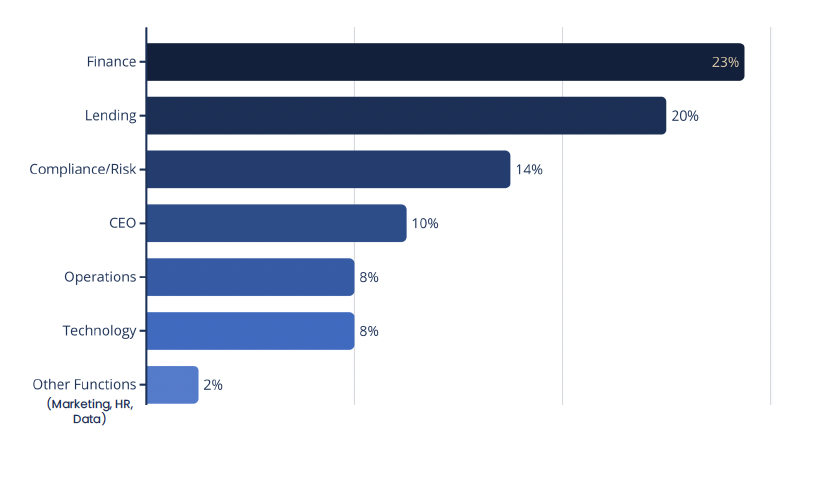

Within McDermott + Bull’s body of work, the functional mix of searches run in 2025 aligned with broader market patterns, with Finance being the one outlier. Our search concentration was as follows:

-

Finance: 23%

-

Lending: 20%

-

Compliance/Risk: 14%

-

Chief Executive Officer: 10%

-

Operations: 8%

-

Technology: 8%

-

(The Balance in various functions including Marketing, Human Resources, Data, and Credit)

The practical implication is straightforward: institutions are consistently investing in the same set of leadership capabilities. As a result, competition for proven executives in these functions is persistent and is not likely to abate in the near term.

Internal Bench vs External Market

Banking is increasingly operating as a national, external executive hiring market. While some leadership roles are still effectively built internally, banks are more frequently buying talent externally when the mandate requires modernization, transformation, strategic repositioning, or scale. Bank leadership movement reflects this: external hiring represents a major share of executive transitions and is most common in roles where organizations are seeking specialized expertise and a fresh approach to growth and customer acquisition.

This distinction matters because it shapes search difficulty. External hiring becomes more difficult when the role requires both deep functional expertise and enterprise-level leadership breadth. In those situations, effective search is less about generating volume and more about accessing scarce, ready-now profiles and calibrating expectations around what the external market can realistically provide.

Why Non-C-Level Searches Can Be the Most Difficult

Another notable trend observed in 2025 was that searches for roles below the C-suite were often as challenging as, and in some cases more challenging than, C-level searches. On average, these engagements ran approximately 10 percent longer and frequently required significantly larger candidate filters to generate a credible slate. The primary driver was a readiness gap: while many candidates demonstrated strong functional depth, fewer possessed the enterprise-wide perspective required for the next level. When roles demanded cross-functional leadership, strategic influence, and governance exposure, the pool of qualified candidates narrowed considerably.

These searches are also more susceptible to process friction. While hiring managers are typically empowered to make final decisions, they often place disproportionate weight on input from stakeholders who were not involved in establishing early alignment, which leads to expanded interview cycles. In addition, lower compensation bands at these levels introduce practical constraints, particularly relocation challenges and dual-household income considerations, that can slow candidate progression. As the process extends, high-quality candidates are increasingly likely to disengage.

Relocation is Common and Manageable When Handled Early

Relocation is not an exception in bank executive hiring. Nationally, among external hires, approximately 72.1% involved moves of more than 100 miles. This indicates that banks are operating in a more national executive talent market than many institutions may assume.

Relocation does not inherently extend timelines. Delays emerge when relocation readiness is tested too late in the process, after significant time has already been invested. Institutions that succeed with relocation tend to qualify it early, align onsite expectations with candidate realities, and structure offers that reflect the total cost and complexity of moving.

Compensation and Candidate Origin

In McDermott + Bull’s body of work in 2025, 78% of searches were filled in the top quartile (or higher) of the compensation range. This reflects a broader market dynamic: external candidates expect a premium to move, particularly when leaving stable organizations, relocating, or stepping into transformation mandates.

Compensation outcomes also reflect candidate origin. 71% of placed candidates came from institutions larger than the hiring institution, reinforcing that many institutions seek leaders with experience at the scale the organization intends to reach. Nearly 40% of placements were aspirational moves – candidates stepping up in seniority while moving to a smaller institution.

These patterns create a predictable trade: credit unions can often attract larger-institution talent by offering increased scope, meaningful influence, and career acceleration, but compensation will frequently land above midpoint. Organizations that plan for this early reduce search drag and increase closing probability.

Work Model Expectations

Nearly 90% of searches we worked on demanded onsite full time, or at least a majority of the work week with an expectation that candidates live in-market. At the same time, many executives continue to prioritize flexibility (whether for lifestyle, family logistics, or dual-career considerations) and strict “in-office at headquarters” requirements can materially narrow the candidate pool. As a result, we are increasingly seeing banks respond with a practical compromise: allowing executives to work out of any office within the institution’s footprint, rather than requiring presence specifically at headquarters. This approach preserves the cultural and operational benefits of being onsite while meaningfully expanding geographic access to talent. It does not mean institutions must be remote-first; it does mean they should recognize the tradeoffs and calibrate role design, timelines, and sourcing strategy accordingly.

M&A as a Talent Catalyst

M&A activity continues to influence the executive talent market in two ways. First, mergers are creating an inflow of active candidates, leaders who proactively explore options as uncertainty is rising. Second, they can make passive candidates within stable institutions more cautious, especially when these candidates perceive that joining a new organization could increase their exposure to future acquisition-driven disruption.

A practical implication is timing: institutions interested in candidates from merging organizations tend to have the highest engagement shortly after public announcements, before retention strategies stabilize the population.

What Leading Institutions Did Differently in 2025

The institutions that hired successfully in 2025 treated executive hiring as both a market exercise and a decision exercise. They did not assume the external market would behave like internal succession. They broadened reach, aligned compensation to reality, and ran disciplined processes that respected candidate time:

-

Expanded geographic reach early and qualified relocation readiness as a first-order criterion.

-

Aligned stakeholders on success criteria before interviews began and used consistent scorecards to evaluate candidates.

-

Streamlined interview loops to reduce calendar friction and avoid candidate drop-off.

-

Planned for above-midpoint compensation outcomes when hiring externally, particularly for scale-ready profiles.

-

Moved quickly when M&A created windows of candidate availability, before retention incentives reduced mobility.

Implications for 2026

Executive hiring in banks is becoming clearer. External movement is common, the best candidates are passive, smaller markets constrain supply, and the capabilities institutions increasingly seek remain scarce.

Institutions that accept these realities and design their hiring approach accordingly will build stronger leadership teams and reduce preventable search friction. Those that rely on narrow geography, midpoint compensation targets, or loosely governed processes will increasingly experience longer timelines and thinner slates.

In conclusion, one of the strongest patterns that left an impression on us is that banks are operating in a more external and national executive hiring market than many leaders realize. With 57.5% of executive moves occurring externally and roughly 72% of external hires requiring more than a 100-mile move, competing for leadership talent requires deliberate geographic reach, disciplined process, and market-aligned offers. In cases where competency gaps are present, looking externally with a structured approach continues to be both necessary and fruitful.

Authors

Brandon Biegenzahn

President

biegenzahn@mbexec.com

Brandon serves as President at McDermott + Bull and leads the firm’s Financial Services Practice, based in Irvine, CA. As President, he leads the strategic buildout and development of the firm’s team of executive search Managing Directors and Partners. As lead of the firm’s Financial Services Practice, he is a partner to an array of financial services firms, including investment banks, commercial banks, private banks, credit unions, asset managers, institutional investors, and fintech companies.

Courtney Dorrel

Partner

dorrel@mbexec.com

Courtney serves as a Partner at McDermott + Bull and co-leads the firm’s Financial Services Practice, based in Irvine, CA. In this role, she leads talent assessment, execution strategy, and overall practice operations. With over a decade of experience in executive search and recruiting, Courtney brings a relationship-driven and execution-focused approach to helping financial institutions attract and retain transformative leadership.