RECENT ACTIVITY IN THE HEALTHCARE INDUSTRY

Private equity healthcare services’ activity levels reached record highs in 2021 and have remained robust throughout the first half of 2022. Of the 105 healthcare services comps, the median enterprise value or EBITDA multiple was 12.3x so far in 2022 compared to 12.5x in 2021. Healthcare companies that have business lines which benefit from favorable consumer demand trends, the use of technology to improve care, the incorporation of value-based care (VBC) payment models, or innovation around site-of-care (telehealth, urgent care, and home care models) are attractive to private equity investors.

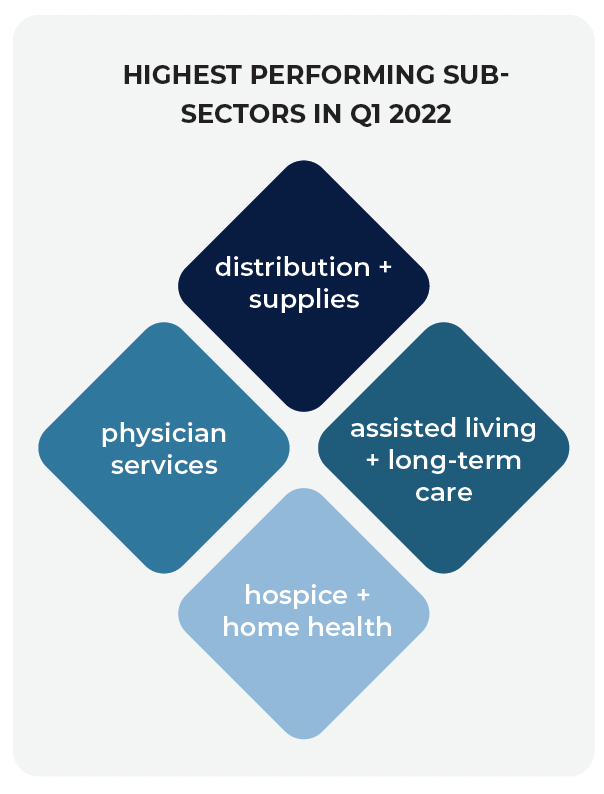

One of the most important trends currently shaping the United States’ healthcare system is the vertical integration between payers and providers, which has created a new class of strategic buyers for healthcare businesses. In the first quarter of this year, the individual sub-sectors that performed the best were distribution and supplies, assisted living and long-term care, hospice and home health, and physician services. Those performing the worst were clinical laboratories, clinical research organizations, and staffing.

In the behavioral health sector, we have seen high trading multiples and private equity interest. There has been a steady increase in reimbursement coverage and rates, driven both by federal and state legislative mandates and by payers’ growing realization that effective behavioral health can improve the overall wellness of their patient population. The pandemic also initiated regulatory and payer movements toward reimbursement parity for telehealth, which can be an effective care delivery mechanism for many patients. These tailwinds present an opportunity for future development in a space that is fragmented and underserved.

As the economy reacts to geopolitical headlines and other macroeconomic headwinds, including inflationary pressure and supply chain disruption, it will continue to effect individual healthcare sub-sectors differently along with M&A activity and trading multiples as we head into the second half of 2022.

ABOUT THE AUTHOR

Garrett Lipus is a Partner of McDermott + Bull and a member of the firm’s Healthcare and Life Sciences Practice. His national practice focuses on serving clients in healthcare services, medical devices, and healthcare technology and his clients range from privately held organizations to public companies and private equity firms that have an investment focus in healthcare or life sciences. Garrett received his BA in business administration from the University of San Diego and was a member of the school’s Division I Golf team.

ABOUT THE FIRM

Leveraging deep vertical experience, innovative thinking, and proven time-saving methodologies, we challenge the norm and thrive in the recruitment of difficult-to find VP to C-Suite executive talent.

We value a personalized service model while having the resources and capabilities of the world’s largest search firms. With experienced partners in Canada, the United States, and Europe, we are the trusted retained search advisor for empowering change on behalf of private and public companies, nonprofit organizations, private equity firms, and their operating companies.