LIFE SCIENCES + HEALTHCARE OUTLOOK IN 2022

When the J.P. Morgan Healthcare Conference took place last January, I skipped it, optimistically thinking that things would be different and safer the following year. Shortly before this year’s conference, it was announced they were going virtual. Outside of these personal disruptions, things were actually very good in 2021 and are continuing to stay strong as we kick off 2022. We see evidence of this in a multitude of ways — the economy continues to soar, consumers are spending after lockdown, procedures are underway at hospitals, and it’s hard to find talent to meet the demand. Most of my clients in healthcare and life sciences are hiring again. Volume is up and everyone is adjusting to the new norm.

I can only imagine what it would be like without global supply chain and inflation issues. Bank of America predicts an easing of inflation and slower growth in GDP, although not by much. Other economic experts anticipate GDP to rise by 3.8 – 4.0%, down from the 4.2% we recently experienced. Omicron still produces uncertainty, but it appears to not be as disruptive as other variants and the unknown.

In this piece, we will look back on the hiring trends from last year and what will carry into 2022. Lastly, we will highlight some areas of preparation that I will cover further in my next piece.

MARKET TRENDS IN EXECUTIVE HIRING

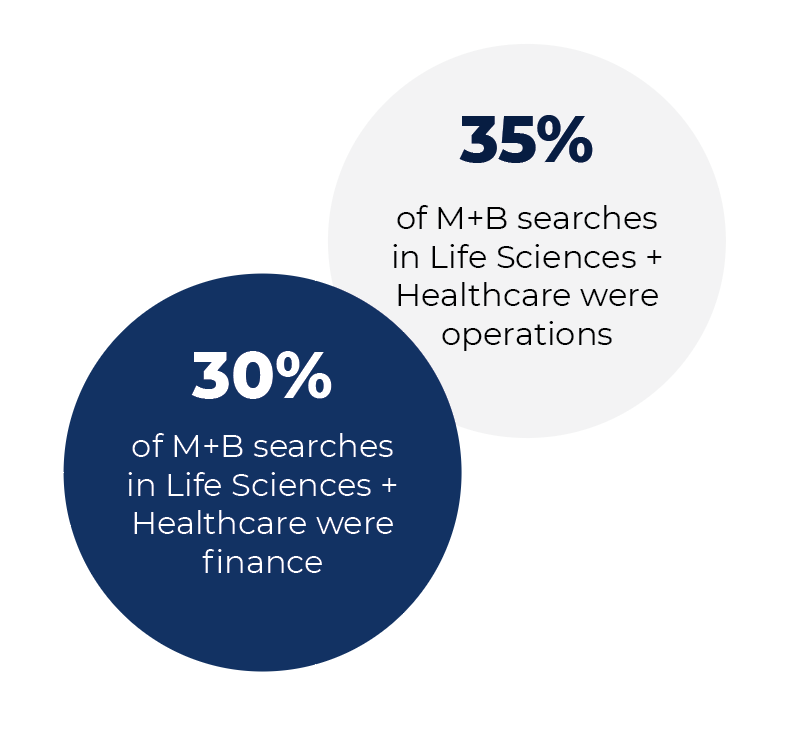

We worked with many life science and healthcare companies in 2021, performing executive searches in various functions, including human resources, manufacturing, finance, research and development, operations, commercial, clinical, and more. Operations led the way, encompassing about 35% of our searches last year. Finance showed an uptick, climbing to 30% of our searches, most of those being Chief Financial Officers. Over half of our searches were private equity sponsored or venture capital-backed growth companies. In operations, we saw much more human resource activity. With all the changes in the marketplace, it makes sense that finance and human resources were key roles in 2021.

LABOR MARKET

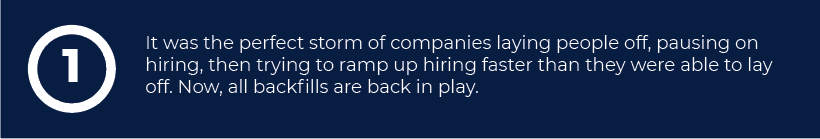

We started 2021 with a very tight labor market, and it has not gotten any easier at the executive level. Across nearly all industries, other than retail and hospitality, the demand for talent at every level of the organization is at a record high. We are seeing this at McDermott + Bull, and a quick glance at the earnings reports of our publicly traded executive search competitors reveals the same.

We often get asked why talent has been so difficult to find. Below are my top reasons.

DEMAND FOR DIVERSITY + INCLUSION CONTINUES

Diversity + Inclusion (D+I) has been a prevalent topic within corporate circles for years. McDermott + Bull continues to push the envelope in this effort, recognizing that D+I is always one of the top three objectives for our clients. In 2021, 51% of our placed candidates were representative of a diverse workforce. What we are seeing now more than ever are candidates demanding to work for companies that not only

speak about their commitment to D+I, but that also demonstrate it in their talent acquisition strategies. In other words, candidates are looking for institutions that have a diverse employee population and are progressive about bringing diversity of thought into the boardroom.

HOW COMPANIES ARE PREPARING

While what has been discussed so far may seem overwhelming, I do not believe it is as dire as it may appear. The weight of acquiring new talent can be offset by ensuring you are building your talent retention strategy. This will also help position yourself as a more attractive option in a candidate’s market. While the prospect of greener pastures sounds interesting, many people are genuinely happy right where they are. So, keep them that way. Let them know they are valued and keep them busy.

Compensation

Keep your compensation up to market by running annual compensation surveys. Evaluate how your competitors are compensating their teams to ensure your payment structure remains attractive and competitive in the marketplace. In a candidate’s market, it is even more important to track comparative salaries in your industry so that your offers remain desirable.

Be Intentional about Interpersonal Relationships

In a remote work environment, it is easy for people to lose touch. Culture, in the way of water cooler talk or grabbing a drink after work, is difficult to maintain. However, you can still create unique moments to bring your people together and ensure that they have time together in person.

Flexible Work Arrangements

This is hard for me to admit, as I’m one of the few who likes a suit and tie and the formality of my workday, but flexibility reigns. If you want people in the office because you like having people around, it is the wrong reason. Look at productivity. If productivity is high when working remote, then keep it that way or at least offer it. To make this easier to stomach, clients of ours who offer fully remote work arrangements are able to attract talent at a lower price because the ability to work remote is a currency in and of itself.

Change is always difficult, but it is frequently accompanied by positive progress. With respect to talent attraction and retention, here’s to adaptation and advancement.

IN CONCLUSION

All things considered, McDermott + Bull fared well compared to many others in 2021. The Life Science and Healthcare Practice is growing at our firm, and it is a trend we anticipate continuing. As a Partner in this niche, I look forward to serving you and continuing to see this segment grow for the greater good of patients across the globe.

Ken Dropiewski

Partner

dropiewski@mbexec.com

Ken Dropiewski is a Partner with McDermott + Bull’s Life Science and Healthcare Practice and has been doing search for nearly two decades. His expertise serves the medical device, biotechnology, and healthcare industry. Ken is especially known for work done in the cardiac, vascular, interventional, and oncology segments and has been in the MedTech field for 30 years. Prior to his career in search, he spent time at Johnson + Johnson and Boston Scientific.