All of us were hopeful that things would turn a corner in 2021, but we were also realistic enough to know it would not happen overnight. Based on interim placement and executive search activity, we are cautiously optimistic that business is moving in the right direction. We wanted to share what we have seen as positive indicators in the first quarter of 2021.

Deal flow and M+A activity have continued to increase steadily since Q4 of 2020. Private equity firms and investment bankers are working with McDermott + Bull Interim Leaders to source finance and operational leaders to step in and provide leadership, implement process improvements, create reporting packages, and lead other pre- and post-acquisition projects. Based on our recent projects and discussions with executives, there have been a few key factors that seem to be driving transactions. This paper details what we see as key drivers to the increase in M+A activity year to date.

Widely Available Capital

Private Equity Hitting Records

Many private equity firms spent part or most of 2020 focused on shoring up and solidifying operations within their current portfolio companies. This led to an excessive amount of dry powder on the sidelines for a large part of last year. By the end of 2020, financial sponsors were sitting on a record $2.9 trillion of available capital1. Private equity is now looking to deploy this capital into new and add-on investments.

We did see the end of the year increase in deal flow like normal, and that trend continued into the first quarter of 2021. According to FactSet Research Systems Inc., the total number of deals for January through February of 2021 was 2,848 compared to 2,550 for January through February of 20202. Considering the numbers for 2020 were pre-lockdown, the uptick in deal flow for 2021 is promising news for what the rest of the year might look like in terms of M+A activity.

Baby Boomer Fatigue

The Time to Sell is Now

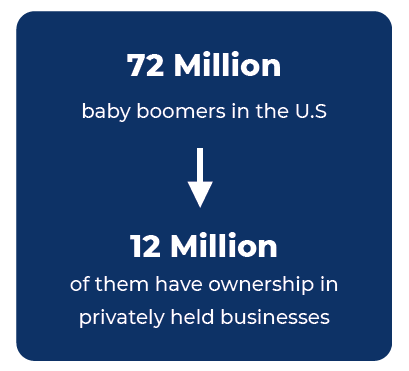

According to recent U.S. Census data, there are approximately 72 million baby boomers in the U.S., and 12 million of them have ownership in privately held businesses. Many baby boomers are seeking a quick exit in lieu of holding off and allowing their business to recover in 2021. Some have fatigue from managing their business through the pandemic and want to enjoy their lives. Others simply aren’t willing to risk managing their business through another crisis. Owners may have been holding off in 2019 to improve their business and ultimately, their price point when they sold. However, after a full year of crisis mode, they are highly motivated to exit and enjoy retirement.

McDermott + Bull Interim Leaders is working with one such company that has a highly successful consumer products business. The owners are in their 70s and the stress of running the business through the pandemic motivated them to sell. They are highly profitable and maintained their revenue throughout 2020, but they have reached a point where they are no longer interested in directly operating the business in the long term. The interim Chief Financial Officer we placed has stepped in to assist with due diligence, fine-tune their financials, and prepare for management presentations. We continue to see similar opportunities with other long-time business owners as well.

Favorable Market Conditions

A Positive Upswing

Many of our current interim engagements are for financial, operational, and human resource executives who can provide leadership and implement processes for add-ons to current portfolio companies, post-acquisition. Since the vaccine has become more accessible and widely distributed, business and consumer confidence has grown. In addition, interest rates remain low. As the global economy continues to rebound, companies have renewed confidence to deploy capital. With borrowing rates remaining at historical lows, they are looking for add-on investment opportunities. This has spurred increases in deal flow early in 2021.

Furthermore, several business sectors that were highly impacted by COVID-19 — like retail, aerospace, and real estate — became risky investments due to uncertainty about their ability to recover. Due to their precarious financial situation, they were reluctant to invest in add-on businesses. Now that markets are solidifying, these industries are rebounding and returning to more normal operating conditions. This could potentially lead to more deals as these industries will have more clarity on valuation for acquisitions or a potential sale.

SPAC Frenzy

Growth in Numbers

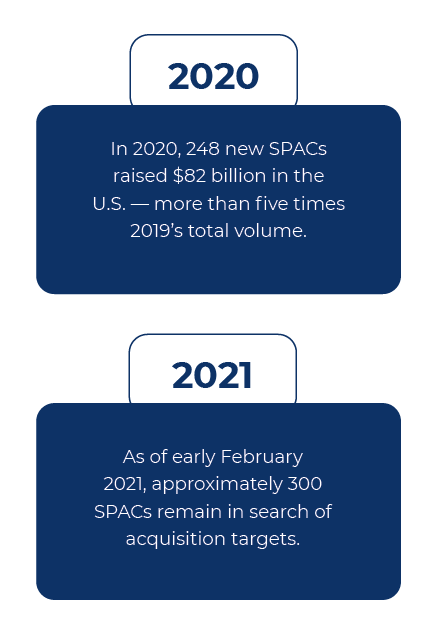

An additional factor increasing deal flow is the major increase in special purpose acquisition companies (SPACs). These shell companies are created for the sole purpose of taking a private company public. The number of SPACs being created has increased substantially over the past six months. In 2020, 248 new SPACs raised $82 billion in the U.S. — more than five times 2019’s total volume3. As of early February 2021, approximately 300 SPACs remain in search of acquisition targets. In the past four weeks, the SPAC market has started to even out and activity is slowing. However, many existing SPACs are looking to see their funds deployed in the public market efficiently, so there is still a sense of urgency to find and invest in target companies, which may drive additional deal flow in 2021.

Given the current favorable market conditions and the increasing demand for interim executive talent, we are optimistic that M+A activity will continue at this pace and likely accelerate in 2021. We are hopeful that the current positive marketplace trends continue and look forward to providing an update based on activity next quarter.

About the Author

Julie Frances

Director, Interim Leaders

jfrancis@mbexec.com

Julie Francis serves as a Director of McDermott + Bull Interim Leaders, where she identifies and secures highly skilled executives to address client companies’ critical business challenges, provide interim leadership, and oversee special projects. She works with executive leadership at middle-market and enterprise-level companies as well as with investment banks and private equity groups to improve operational and financial performance.

Citations

1. Preqin. Includes venture, growth, buyout, real estate, mezzanine, direct lending, natural resources, infrastructure, distressed debt and other funds.

2. https://www.factset.com/hubfs/mergerstat_em/monthly/US-Flashwire- Monthly.pdf

3. Dealogic